Best Debt Consultant in Singapore: Comprehensive Financial Solutions

Discover Just How Specialist Financial Obligation Specialist Solutions Can Help You Regain Financial Stability and Handle Your Financial Debt Effectively

In today's complex monetary landscape, numerous people discover themselves grappling with overwhelming financial obligation and unpredictability regarding their financial future. Professional financial debt consultant solutions supply a structured strategy to regaining security, giving customized methods and expert insights developed to address distinct financial challenges.

Recognizing Debt Specialist Provider

Financial debt professional services give people and organizations with expert advice in handling and settling financial responsibilities. These services goal to help customers in browsing complex monetary landscapes, using customized techniques to address differing degrees of debt. A financial debt specialist typically assesses a customer's monetary scenario, including revenue, expenditures, and existing financial obligations, to develop a thorough strategy that lines up with their one-of-a-kind demands.

Professionals use a range of approaches, such as budgeting support, debt loan consolidation options, and arrangement with lenders - debt consultant singapore. By leveraging their proficiency, they can assist customers recognize the effects of their financial debt, including rate of interest prices, payment terms, and potential legal consequences. Additionally, experts frequently educate customers regarding economic proficiency, encouraging them to make informed choices that can cause lasting financial health and wellness

Furthermore, these solutions may include creating organized payment strategies that are lasting and workable. By teaming up very closely with clients, financial obligation consultants promote a supportive environment that motivates commitment to monetary technique. On the whole, understanding the range and functions of financial obligation professional services is vital for individuals and companies seeking reliable solutions to their economic challenges, eventually paving the means to better financial stability.

Benefits of Specialist Assistance

Professional advice in financial debt administration supplies countless benefits that can significantly improve an individual's or service's financial situation. Among the key advantages is access to professional knowledge and experience. Financial debt specialists possess a deep understanding of different financial items, legal regulations, and market problems, allowing them to supply educated advice tailored to details situations.

In addition, financial debt experts can provide settlement skills that people might lack. They can interact properly with creditors, potentially securing better repayment terms or minimized rate of interest. This advocacy can result in a lot more favorable end results than people can achieve on their own.

Tailored Methods for Financial Debt Management

Efficient financial obligation management calls for even more than simply a standard understanding of monetary obligations; it requires methods tailored to an individual's unique conditions. Each individual's economic scenario is distinct, affected by numerous elements such as revenue, expenditures, credit rating, and individual goals. Specialist financial debt experts excel in developing personalized plans that deal with these certain elements.

Via an extensive evaluation, experts recognize one of the most important debts and evaluate investing behaviors. They can after that propose efficient budgeting techniques that align with one's way of life while prioritizing financial debt their website repayment (debt consultant singapore). In addition, specialists may suggest consolidation strategies or arrangement techniques with financial institutions to reduced rates of interest or establish convenient layaway plan

A substantial benefit of tailored techniques is the versatility they use. As situations alter-- such as task loss or enhanced costs-- these approaches can be adjusted as necessary, ensuring recurring relevance and performance. Moreover, experts offer ongoing assistance and education, equipping individuals to make enlightened choices in the future.

Inevitably, customized debt management techniques not just facilitate instant relief from monetary problems yet additionally foster lasting monetary security, enabling people to regain control over their financial resources and attain their monetary goals.

Just How to Pick a Specialist

Exactly how can one make certain that they choose the appropriate debt expert for their requirements? Choosing a financial obligation expert calls for cautious factor to consider of numerous vital aspects. First, evaluate their credentials and experience. Look for experts with pertinent accreditations, such as those from the National Foundation for Credit Rating Counseling (NFCC) or the Organization of Credit Score Therapy Experts (ACCP) Their knowledge in handling financial obligation remedies is critical.

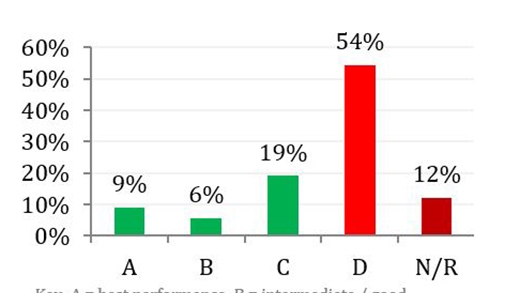

Following, evaluate their online reputation. Research study online testimonials and testimonies to gauge the experiences of previous customers. A reliable specialist will certainly often have favorable comments and a record of successful debt management end results.

It is additionally necessary to recognize their method to debt administration. Arrange a consultation to review their methods and ensure they line up with your monetary goals. Transparency relating to fees and solutions is vital; a reliable expert must provide a clear summary of prices involved.

Finally, take into consideration the consultant's communication design. Pick a person that click for more listens to your concerns and solutions your inquiries clearly. A strong rapport can cultivate a joint partnership, important for efficiently managing your financial debt and accomplishing financial security.

Steps to Attain Financial Stability

Achieving economic security is a systematic process that includes a series of intentional steps tailored to specific circumstances. The first step is to examine your present economic circumstance, including revenue, possessions, expenditures, and financial debts. This detailed analysis gives a clear photo of where you stand and helps determine areas for enhancement.

Next, produce a reasonable budget that prioritizes vital costs while alloting funds for financial debt settlement and financial savings. Staying with this budget plan is crucial for keeping monetary self-control. Following this, explore financial debt monitoring choices, such as consolidation or settlement, to lower rate of interest and regular monthly settlements.

Develop a reserve to cover unforeseen costs, which can stop dependence on credit history and more financial obligation buildup. Once instant financial stress look at here are attended to, concentrate on lasting economic goals, such as retired life financial savings or financial investment techniques.

Conclusion

In verdict, expert financial obligation expert solutions use valuable sources for individuals seeking economic stability. By giving specialist support, customized techniques, and ongoing assistance, these consultants help with reliable financial debt management.

In today's complex monetary landscape, lots of individuals find themselves grappling with frustrating financial debt and unpredictability about their economic future. Specialist debt consultant services provide an organized strategy to restoring security, giving customized approaches and skilled understandings designed to address one-of-a-kind financial challenges. A financial debt consultant commonly reviews a client's economic scenario, including income, expenses, and existing debts, to develop a detailed strategy that straightens with their distinct requirements.

On the whole, understanding the scope and functions of financial debt consultant services is essential for companies and people seeking efficient services to their monetary difficulties, eventually paving the way to better monetary security.

In verdict, expert financial obligation specialist services offer important sources for individuals looking for financial security.